AI has become a hot-button topic over the past year, set to transform a swathe of industries, including the world of finance.

The scale of AI adoption in the finance industry is rapidly expanding. According to a report by Forbes, 54% of Financial Services organizations with 5,000+ employees have already adopted some form of AI. Additionally, findings from JLL reveal that banking and insurance companies worldwide are anticipated to spend an additional $31 billion on AI by 2025.

Despite the majority of finance brands taking steps to stay ahead of the technological curve, many other financial enterprises may not be aware of the benefits of AI in finance – and will lose their competitive edge as a result.

If organizations want to stay ahead of the curve, they must embrace AI innovations and seize the opportunities it provides. In this article, we’ll explore what Generative AI (Gen AI) is and what challenges financial services companies face in embracing AI from a security and data management standpoint. Plus, we’ll also look at how tools like Stratio Generative AI Data Fabric help businesses give meaning to the masses of financial data coming into their organizations, and use that data to their advantage.

Generative AI 101

The term ‘Generative AI’ refers to AI models designed to analyze and assimilate the vast volumes of data enterprises hold from various sources. AI in finance breaks down silos, connecting dots and processes between datasets that might otherwise remain isolated.

Gen AI can be used to draw out crucial insights, automate tasks, and even help human agents formulate new ideas and strategies based on their findings.

For instance, organizations can deploy Gen AI to summarize documents, build tables, build dashboards, create new and meaningful text, generate code, and synthesize ideas. It can also improve customer service beyond simple chatbots by facilitating self-service capabilities — making more products available to more clients thanks to 360-degree customer views.

Additionally, Gen AI can even combat cyber threats, helping internal teams and experts become more productive and knowledgeable in this area. It can do all this through a chat-bot interface, allowing human users to interact with the technology through natural language queries, making it intuitive and quick to use.

Benefits of Generative AI

Generative AI relies on an ontology, which is essential for semantic interoperability. The technology provides an agreed-upon system of terminology to describe and exchange data between banks, investment firms, and regulatory agencies. It also facilitates and standardizes data exchange, making it easier for human-to-machine and machine-to-machine communication in future.

Accuracy is king for the financial industry; which handles more sensitive and confidential information than most sectors. Poor data quality and bad data governance create issues — ranging from inefficiencies to bad decision-making. In contrast, Generative AI provides a holistic data view, making governance more straightforward. Through its easy-to-use interface, financial enterprises can make light work of keeping up with regulatory compliance.

For instance, suppose an investment firm must report shares, derivatives, and bond transactions. In that case, they can use a Gen AI-assisted data fabric architecture to unify all relevant data into the accessible business data layer- saving employees from unifying the data manually.

Additionally, Gen AI can create synthetic data closely resembling real-world financial data. This provides context to real data, enhancing the user’s ability to identify trends and patterns from the data they receive. Thus, the tech can make essential leaps of logic even when there is missing or incomplete data. This, in turn, means that financial industry stakeholders can leverage AI’s analysis and advice to anticipate changes in the markets they operate in or make more informed business-related decisions.

Other ways in which Generative AI can help financial industry

Generative AI can also automate manual tasks — like data analysis and fraud detection — which can help financial enterprises enhance operational efficiency, reduce human error, and lower associated costs by making decisions in the short term, near to real time. It’s capable of parsing vast volumes of financial data, such as trading volumes and market indicators, and then zooming in on key insights that inform other aspects of financial businesses, such as risk management strategies or fraud detection.

So, where is the best place to start for those financial companies looking to invest in Generative Ai?

Stratio’s Generative AI

Stratio’s mission is to help integrate Generative AI in finance. We have the experience and expertise to help the insurance and finance industries get the most out of this new technology.

Generative AI works best in tandem with high-quality data. Stratio Data Fabric architecture (the most powerful data management solution today) works by using machine learning (ML) algorithms to automatically retrieve data from multiple sources, integrated into a centralized framework (a virtualization layer).

It’s designed to have AI operating within this machine learning-derived system and a set of data-driven practices that make data management fast, precise, and secure.

Stratio’s first-of-its-kind data management solution also combines actionable and declarative frameworks with natural language processing.

Our team has a proven track record of collaborating with companies in the finance industry to provide data consistency and real-time insights to help them get the most out of their data and accelerate their working practices.

The solution can easily integrate with existing infrastructure and is designed to be intuitive to use by anyone within the organization. We’ll work with you to determine your digital transformation needs and develop a five-step process to efficiently get you up and running with our cutting-edge technology.

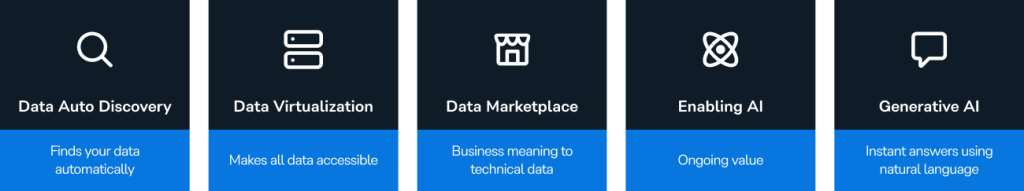

Steps:

- Auto Discovery of Data – We deploy AI-powered algorithms to break down information silos, centralize governance, and uncover all critical data sources.

- Data Virtualization – We generate virtualized copies of all your data points on-prem and in the cloud to facilitate real-time data access and maintain data integrity.

- Data Marketplace – We map your data and its semantic relationships, giving your newly formed Data Fabric meaning, without compromising on governance and security.

- Enabling AI – We deploy machine learning tools to build Knowledge Graphs and refine your semantic ontologies, helping you identify revenue-building opportunities.

- Instant Answers with Gen AI – Finally, an LLM layer is added, giving all users the freedom to submit natural language data queries in any language.

Discover What Stratio Generative AI Data Fabric Can Do For You

In summary, Generative AI has enormous potential to enhance financial services operations, build consumer trust, and give companies the freedom to develop new products and services.

So, if you’re ready to start your Gen AI journey, contact us now to request a demo.