Banking and insurance companies are now under increasing pressure to meet evolving regulatory requirements, while still remaining innovative and competitive. A Cloud adoption strategy is becoming mainstream in financial services companies globally targeting three main objectives:

- First, to benefit from Cloud infrastructure’s lower costs and significantly better capabilities to scale compared to ”On prem” infrastructure (elasticity, containers, etc).

- Second, to access new state-of-the-art Cloud services related to Cloud storage, analytics, and transactional services that are improving and evolving constantly.

- Third, to develop new Cloud-based Global Digital Businesses platforms with faster time to market and roll out strategy in terms of countries and services.

However, when adopting Cloud, the following challenges emerge as the most common:

- First challenge: manage costs of Cloud in an efficient way as many early adopters have faced higher costs than expected.

- Second challenge: meet regulatory requirements regarding “portability” of solutions from one Cloud to another and back “on-prem”. This means avoiding “Cloud lock-in”.

- Third challenge: be able to make a Cloud migration in a fast “time to market” scenario, limited costs of migration, and allowing Cloud data to be governed and compliant.

Stratio Generative AI Data Fabric is helping banks and insurance companies get the maximum value from Cloud adoption and resolve the three key challenges.

How Stratio Accelerates Cloud Adoption for Financial Services

Banking and insurance companies need a solution that reduces the time and effort in migrating data processes, and core applications to the Cloud.

Financial services brands looking to speed up cloud migration to unlock more brand value can benefit from the power of Stratio Generative AI Data Fabric.

In this article, we explore how Stratio Generative AI Data Fabric solution is helping banks on two fronts:

- Allowing banks & insurance to maximize value from Cloud adoption and resolve challenges.

- Reducing the costs by > 50% and time to market by around 50% associated with Cloud migration of data stores and core applications.

Allowing banks and insurance companies to maximize value from Cloud adoption and resolve challenges

Here are three key ways how cloud Adoption elevates brand value in the modern, hyper-competitive financial services landscape with Stratio Generative AI Data Fabric:

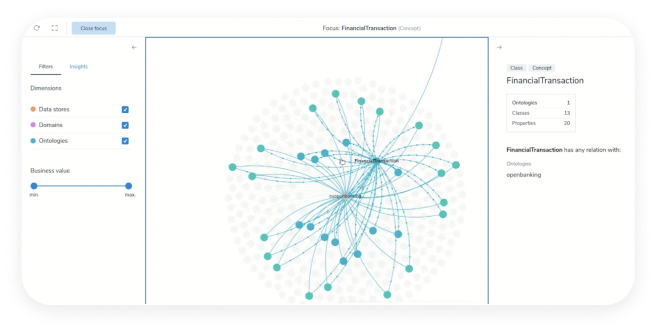

1. Democratizing data access with high business value

As data becomes the lifeblood of decision-making, breaking down information silos is vital. Distributing data with business meaning, quality and embedded data access controls becomes strategic.

Stratio allows a Cloud adoption strategy enabling banks and insurance companies to access real-time data services and analytics with governed data, to ensure that companies can extract the maximum value from their data in multiple use cases.

As soon as data is migrated to the Cloud with Stratio Data Fabric, data gains business meaning, quality, and security. Therefore such data is ready to be used in business use cases.

2. Migrating new-generation core banking applications

Developing new value propositions is critical to maximizing user experience and business ROI. Minimizing risk while testing, experimenting, and replicating new services or customer journeys is essential.

New Cloud core applications (core banking, core insurance, cards app, merchant apps, etc) and their new microservices and API-heavy architectures become critical to providing a unique customer experience with personalized services.

Stratio Data Generative AI Data Fabric allows to accelerate migration from legacy “on prem” core applications to new generation core applications in the Cloud. And does this so well that one of the leading global banks has a Center of Excellence of core banking apps migration to Cloud with Stratio.

In addition, real time core applications data available with business domains, quality, consistency, and security allows banks and insurance enterprises to deliver high value business services with real time insights (fraud detection, AML, payments insights, etc).

3. Maintaining compliance within a Cloud adoption strategy

Financial compliance protects consumers and companies from fraud and increasingly-sophisticated cyber threats. It also guarantees the right use of customer data and the ethical use of AI. .

Cloud adoption requires additional compliance checks and regulatory requirements that Stratio Generative AI Data Fabric helps meet in an easy way:

- Stratio allows to avoid “Cloud lock in” as it helps banks and insurance companies to build a multicloud or hybrid (on prem and cloud) strategy. Creating a data fabric-enabled multi-cloud environment facilitates increased data security; making it easier for companies to switch cloud providers, should the need arise.

- Stratio enforces data protection policies consistent between on prem and Cloud and based on business domains.

- Stratio allows to encrypt, mask and define granular data protection policies for each user that will be automatically enforceable.

It also gives financial services brands with operations in several countries or even continents more choices in managing their data. This can prove very useful if compliance regulations change and companies need to update their offerings to stay ahead of the competition.

Stratio reduces the costs by > 50% and time to market around 50% to migrate data stores and core applications to the Cloud

At Stratio, we have extensive experience helping banks and insurance companies accelerate Cloud migration. A leading Global Bank has a Center of Excellence of Cloud migration of core applications with Stratio and they are reducing 50% time to market of migration due to Stratio Data Fabric according to their migration experts.. Our Stratio Generative AI Data Fabric product has several unique features that make it ideal for speeding up your cloud migration journey, including:

1. Accelerating data discovery from legacy source system

We use our AI-assisted data discovery tool to uncover all data locked away in your on-prem data stores. This improved accessibility enhances our customers’ understanding of their data environment and helps them assess which stores need to be migrated or utilized differently to promote innovation. Data discovery 75% less time and costs.

2. Accelerating business domain mapping to legacy source systems

Once we have discovered all data to be migrated to the Cloud, we create virtualized copies, leaving your original stores intact.

We implement a business domain logical model that reflects the Business Data Layer available in the cloud. Stratio AI-assisted accelerators allow for an semi-automatic mapping of business domains to legacy data using data patterns and AI solutions. This crucial process reduces the time and effort in mapping your organization’s data and defining semantic relationships between data sets by 75%.

As a result, Business Domain for “end users in cloud” mapping 50% less time and costs.

3. Accelerating implementation of quality controls, MDM and data transformations for migration

Stratio also automates data governance throughout the data lifecycle through its centralized data fabric product. Once the data is discovered and virtualized, Stratio applies security attributes, data quality controls, and consistency checks, making the data ready for migration after all the controls have been tested adequately.

Subsequently, financial services brands can test new propositions without compromising customer security, data integrity, and regulatory compliance.

Implementation of quality controls , MDM and others 35% less time and costs.

4. Accelerating data uplift with one automatic process

Additionally, Stratio simplifies data uplift to the Cloud as it allows to automatically migrate data with Business views with embedded quality controls and fine grained security tags.

Hence data uplift to the Cloud is done by migrating only the required data for use cases and is ready to be used as soon as it is migrated.

It is also possible to synchronize the data on prem with the data in the Cloud when required using the business views and CDC technology. This allows to manage the period of hybrid use of data in a simple way before full migration takes place.

Data uplift in one process with business views vr multiple ETLs means > 50% less time and costs.

Accelerating ROI and payback of migration

Our approach to capturing cloud data and automatically imbuing it with business context significantly reduces the cost of cloud migration overall.

For example, Stratio ensures that only crucial data sets are transferred to new applications, saving companies time and effort in data processing and storage.

Stratio’s Generative AI layer can also build and optimize AI models based on accurate, up-to-date enterprise data. This allows brands to create data products and automate workflows without writing a single line of code.

Payback of migration on less than 12 months and ROI > 100% in year 2

Case Study: How Stratio accelerated a global banking group’s Cloud migration

We have recently established a Center of Excellence within a multinational global banking group specializing in merchant business growth and personal finance products. One country merchant business migration in 9 months with around 50% less time and costs.

Operating in 12 counties, and offering more than 20 digital products to its worldwide customer base, our innovative data fabric product delivered the perfect solution for rolling out two separate data models for their credit card and merchant account propositions.

We enabled seamless data replication and reuse across multiple countries, helping the bank take huge strides in its digital transformation journey and reach its ultimate goal of hosting its core banking platforms in the cloud.

Stratio paves the way to a smoother Cloud migration

Our extensive experience, and commitment to data management innovation make Stratio the ideal partner for any financial services brands seeking to thrive in a cloud-centric world.

By breaking down data silos, providing real-time access to all systems, and maintaining data governance at all times, we provide banks and insurance companies with all the tools they need to compete in their rapidly changing industries.

Moreover, Stratio Generative AI Data Fabric product is complementary to other governance and BI tools and technologies, improving your company’s ability to make decisions in the short term.

So, if you want to learn more, get in touch or request a demo.